Cases Reported in ITR| Latest Cases on Income Tax Laws

Explore the latest cases reported in Income Tax Reports (ITR) Volume on Return of Income, Royalty, Exemptions, Investment business, Reassessment, Appeal and much more.

Explore the latest cases reported in Income Tax Reports (ITR) Volume on Return of Income, Royalty, Exemptions, Investment business, Reassessment, Appeal and much more.

On 01-06-1958, the Government of India published a notification in the exercise of powers conferred under Section 3(e) of the Mines and Mineral (Regulations and Development) Act, 1957 by which brick earth was declared a minor mineral within the meaning of the 1957 Act.

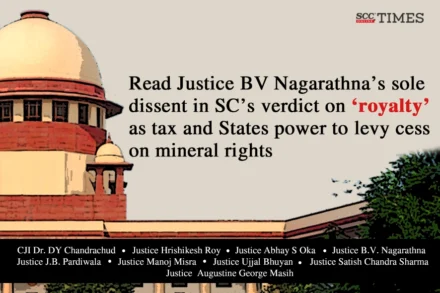

2024 was a year of pathbreaking verdicts on several issues such as Electoral Bonds, Citizenship Act, Tax/Royalty on Mines, Minority Institutions etc. Some major issues saw unanimous and near unanimous verdicts by the Supreme Court; however, there were notable Dissenting Opinions in 2024 which shed light on several key legal concepts.

Even though the Court declined to declare Explanations to Rule 38 of MCR, 2016 and Rule 45(8)(a) of MCDR, 2017 as unconstitutional, it took strict note of the anomaly in the provisions vis-a-vis computation of royalty to be levied for the extraction or consumption of mined ores and gave the Respondents one last chance to resolve the issue.

Justice B. V Nagarathna who is currently serving as a Judge of Supreme Court of India, formerly served as a Judge of Karnataka High Court until her elevation to the Supreme Court. Justice Nagarathna is also the potential contender for the first ever woman Chief Justice of India.

“Royalty is in the nature of a tax or an exaction. It is not merely a contractual payment but a statutory levy under Section 9 of the MMDR Act.”

Supreme Court said that authorizing the Central Government to lay down the terms of mining leases and grant approval to concessions, the MMDR Act seeks to ensure that there is uniformity in the terms for working of mines and extraction of minerals.

“The payments made to the Government cannot be deemed to be a tax merely because the statute provides for their recovery as arrears”.

This matter was the oldest pending nine-judge Bench case before the Supreme court. The Bench had reserved its judgment in the matter on 14-03-2024

The Tribunal stated that there is no such condition in the Technology License Agreement which provides that royalty payment is a pre-condition for sale/import of raw materials and there is no evidence to establish how the royalty payment is linked to the import of raw materials.

“For a service to be categorized as a technical service, it has to be concerned with applied science, i.e., using scientific knowledge for practical applications, or industrial science concerning, relating to, or derived from industry.”

While Xiaomi’s petition was held to be maintainable on the fulcrum of Article 14, however, the impugned provision as per the High Court did not manifest any arbitrariness.

Delhi High Court: In a case where application was filed by Nokia under Order 39 Rule 10 of CPC, the

Madras High Court: A Division Bench of R Mahadevan and Sathya Narayan Prasad, JJ. dismissed the tax appeal holding that guarantee commission

by Dr Srikant Parthasarathy† and Dr Amirthalakshmi R††

Bombay High Court: G.S. Patel, J., while addressing a matter wherein the offence of defamation has been alleged, expressed: Simply using another’s

DTAA provisions must be treated as law and followed by Indian courts, notwithstanding what may be contained in the Income Tax Act to the contrary, unless more beneficial to the assessee.

Income Tax Appellate Tribunal (ITAT): A two-member Bench of Saktijit Dey, Judicial Member and Manoj Kumar Aggarwal, Accountant Member, allowed the appeal

Madhya Pradesh High Court: This petition was filed before a Division Bench of S.C. Sharma and Virender Singh, JJ., against the order