Authority for Advance Ruling (AAR)

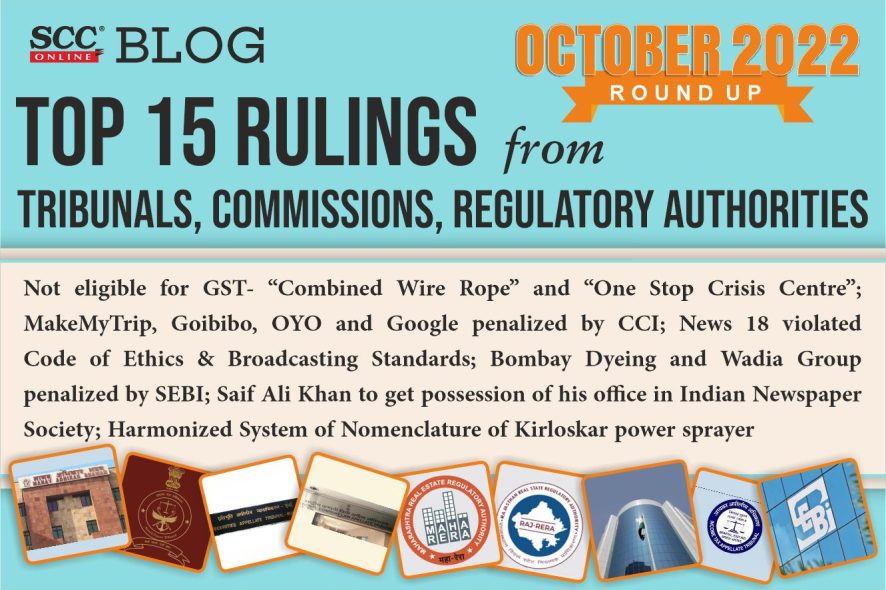

Gujarat Authority for Advance Ruling| ‘Combined Wire Rope’ not a part of the fishing vessel, thus, not eligible for GST at 5 percent

In an application sought for advance ruling on the question that whether Goods and Services Tax (GST) rate of 5 percent under entry No. 252 of Schedule 1 of Notification No. 1/2017 of Central Tax Rate and a corresponding notification issued by Gujarat State and Notification No. 1/2017 of Income Tax Rate is applicable in the case of “Combined Wire Rope” used as a part of a Fishing Vessel, the two-member bench of Milind Kavatkar and Amit Kumar Mishra has ruled that the combine wire rope has no use in the fishing vessel, but it is used to tie the fishing net, thus, it is not covered under entry No. 252 of Schedule 1 of Notification No. L/20l7 of Central Tax (Rate) and is not eligible for GST at 5 percent.

Maharashtra Appellate Authority for Advance Ruling | “One Stop Crises Centre” Scheme can be construed as subsidy, not subject to GST; Set aside MAAR ruling

In an appeal filed under Section 100 of the Central Goods and Services Tax Act, 2017 (‘CGST’) and the Maharashtra Goods and Services Tax Act, 2017 (‘MGST’) being aggrieved by the advance ruling passed by the Maharashtra Authority of Advance Ruling (MAAR), the two-member bench of Ashok Kumar Mehta and Rajeev Kumar Mital while setting aside the ruling passed by the MAAR, held that since the impugned activities undertaken by the appellant are not construed as “supply” in terms of section 7(1)(a) of the CGST Act, 2017 the reimbursement amount paid by the Maharashtra Government to the appellant for undertaking the activities specified under “One stop Crises Centre Scheme” floated by the Central Government, will not be subject to the levy of GST.

What is the HSN code and GST rate for a Mechanical Sprayer? Gujarat Authority for Advance Ruling answers

In an application sought for advance ruling on the question that, what is the Harmonized System of Nomenclature (HSN) and Goods and Services Tax (GST) rate of Kirloskar power sprayer, the two-member bench Milind Kavatkar and Amit Kumar Mishra has ruled that the 8-digit HSN code of the applicant’s product is 8424 89 90 and the applicable GST rate would be l8 percent.

Gujarat Authority for Advance Ruling| GST is not leviable on the amount representing employees’ portion of canteen and transportation charges

The two-member bench Milind Kavatkar and Amit Kumar Mishra has ruled that Goods and Service Tax (GST) is not leviable on the amount representing the employees portion of canteen and transportation charges, which is collected by the applicant and paid to the third party, and as the provision of services of transports and canteen facility to its employees is as per the contractual agreement between the employee and the employer in relation to the employment, thus such provision cannot be considered as supply of goods or services, and hence, cannot be subjected to GST.

National Company Law Appellate Tribunal (NCLAT)

Whether Adjudicating Authority is competent to pass order under Section 66 of IBC during subsistence of moratorium under Section 14 of IBC? NCLAT answers

While deciding an issue as to whether the adjudicating authority is competent to pass an order under S. 66 of Insolvency and Bankruptcy Code, 2016 during the subsistence of moratorium under S. 14 of IBC, a 3-judge bench comprising of Ashok Bhushan, M. Satyanarayana Murthy*, JJ., and Barun Mitra (Technical Member), held that the moratorium issued under S. 14 of the IBC does not bar proceedings against the resolution professional for defrauding the creditors of its Corporate Debtor.

Non-payment of full provident fund and gratuity violative of S. 30(2)(e) IBC; NCLAT directs Jet Airways to make payments

In a batch of appeals filed challenging order dated 22-06-2021 passed by the National Company Law Tribunal (NCLT), Mumbai approving the Resolution Plan submitted by ‘Jalan Fritesch Consortium’ with respect to the Corporate Debtor — ‘Jet Airways (India) Limited’ on various grounds primarily being non-payment of full provident fund, gratuity, leave encashment etc to the employees and workmen who are rightly entitled to it, a Division Bench of Ashok Bhushan J. (Chairperson) and Barun Mitra J. (Technical Member) held that non-payment of full provident fund amount to the workmen and employees and the gratuity payment till the insolvency commencement date amounts to noncompliance of provisions of Section 30(2)(e) of Insolvency and Bankruptcy Code, 2016 (IBC) finding no other parts of the resolution plan to be infirm in any manner. The Court further directed the Successful Resolution Applicant to make pending payments of provident fund and gratuity to the workmen and the employees.

Competition Commission of India (CCI)

“Fair market opportunity is the hallmark of competition”; CCI imposes hefty monetary penalty on MakeMyTrip, Goibibo and OYO for their anti-competitive practices and abuse of dominant position

In a significant development, the Commission while deliberating upon the alleged contravention of Sections 3 and 4 of the Competition Act by MakeMyTrip, Goibibo and OYO, was of the view that the commercial arrangement between OYO and MakeMyTrip and Goibibo which led to the delisting of FabHotels, Treebo and the independent hotels, which were availing the services of these franchisors, was anti-competitive and abuse of dominant position within the meaning of Section 3(4)(d) read with Section 3(1) of the Competition Act.

Google faces penalty of Rs. 1337.76 crores for abusing its dominant position in multiple markets in the Android Mobile Device Ecosystem; Cease and Desist order issued

The Commission Bench comprising of Ashok Kumar Gupta (Chairperson), Sangeeta Verma and Bhagwant Singh Bishnoi (Members) in a significant 293-page ruling, imposed a heavy penalty on Google of Rs. 1337.76 crores for abusing its dominant position in multiple markets in the Android Mobile device ecosystem thereby contravening Sections 4(2)(a)(i), Section 4(2)(b)(ii), Section 4(2)(c), Section 4(2)(d) and Section 4(2)(e) of the Competition Act.

Income Tax Appellate Tribunal (ITAT)

Why did ITAT decide to delete the addition of streedhan as ‘unexplained investment’ for the purposes of income assessment? Read to know

While deciding the instant appeal revolving around the addition of the assessee’s generational streedhan as unexplained investment for the purposes of income assessment, the Bench of Sandeep Gosain (Judicial Member) and Rathod Kamlesh Jayantbhai (Accountant Member), held that the AO ignored and failed to verify the factual position in the instant matter whereby which it was clear that the assessee lives with his parents and belongs to the high-status Rajput family where it is traditional to have jewellaries received from mother and wife in the form of streedhan. The Tribunal, keeping in mind the high status, family tradition, deduction on account of purity and the deduction towards streedhan, held that the excess jewellary found during search was nominal and the addition sustained by the CIT(A) deserves to be deleted on the grounds raised by the assessee.

Central Information Commission

No information of the third parties can be sought via the RTI Act without their consent

In a second appeal filed by the appellant under Section 19 of the Right to Information Act, 2005 on the ground of arbitrary denial of information by the Chief Public Information Officer (CPIO), the Chief Information Officer, Amita Pandove has held the information sought by the appellant was rightly denied by the CPIO as it pertains to the third party who expressed their dissent from divulging the same to any other third party.

Central Information Commission directs All India Chess Federation to furnish its expenditure in case against Competition Commission of India

Central Information Commission directs All India Chess Federation to furnish its expenditure in case against Competition Commission of India In the second appeal filed by the appellant under Section 19 of the Right to Information Act, 2005 (‘Act’) on the ground of unsatisfactory reply furnished by the Chief Public Information Officer (‘CPIO’), the Chief Information Officer, Amita Pandove has directed the CPIO, All India Chess Federation (‘AICF’), to provide relevant information regarding the expenses incurred by AICF, since it is a public authority and uses public money.

News Broadcasting & Digital Standards Authority (NBDSA)

News 18 debate programme violative of the Code of Ethics & Broadcasting Standards and principles under the Specific Guidelines Covering Reportage; News Broadcasting & Digital Standards Authority imposes fine of Rs. 50,000/- on the broadcaster

In a complaint regarding a debate programme aired on News18 India on 6.4.2022, wherein the anchor Aman Chopra referred to the Muslim students as “Hijabi Gang”, “Hijabwali Gazwa Gang” and made a false allegation that they had resorted to rioting, A.K Sikri (Chairperson) held that the impugned programme was violative of the principles relating to impartiality, neutrality, fairness and good taste & decency under the Specific Guidelines Covering Reportage, apart from the Code of Ethics & Broadcasting Standards.

Securities and Exchange Board of India (SEBI)

SEBI imposes a penalty of Rs. 2.25 crores on Bombay Dyeing and Rs. 11 crores on Wadia Group for misrepresenting financial statements

The Bombay Dyeing and Manufacturing Company Ltd. (‘BDMCL’) and some of its promoters (Nusli Wadia, Ness Wadia and Jehangir Wadia) has been barred from the securities market for 2 years for violating the provisions of SEBI (Prevention of Fraudulent and Unfair Trade Practices) (‘PFUTP’) Regulations, 2003 by misrepresenting the financial statement of BDMCL originating from year 2011 until 2019.

Maharashtra Real Estate Regulatory Authority (MRERA)

Maharashtra RERA| Saif Ali Khan to get possession of his office unit in Indian Newspaper Society within a period of 15 days, with interest for delayed possession

In a complaint filed for seeking directions to the respondent to handover the possession and to pay interest/ compensation for the delayed possession as per the provisions of section 18 of the Real Estate (Regulation & Development) Act, 2016 (‘RERA’), Mahesh Pathak (Member) has directed the respondent to handover possession of the said units to Saif Ali Khan-complainant within a period of 15 days from the date of this order and directed to pay interest for the delayed possession to Saif Ali Khan from 1.02.2018 till 12.02.2021. Further, the respondent is entitled to claim the benefit of “moratorium period” as mentioned in the Notifications issued by the Authority. Moreover, it directed Saif Ali Khan to pay interest for the delayed payment from the date of default till the actual date of payment at the rate prescribed under RERA i.e. Marginal Cost Lending Rate (MCLR) of SBI plus 2%.

District Consumer Dispute Redressal Commission

Why Uber India was held liable for the cab driver whose negligence caused the complainant to miss her flight to Chennai?

In a significant decision delivered in August over a complaint alleging deficiency of service on part of Uber India Systems, the Bench of R.P. Nagre (President-in-Charge), G.M. Kapse and S.A. Petkar (Members) held that Uber India is liable for providing deficient services on behalf of the cab driver in the instant case, whose negligence caused the complainant to miss her flight to Chennai. It was further held that Uber India’s liability was caused as the driver was acting as an agent of the Company while receiving the consideration i.e., the cab fare.

*Kriti Kumar, Editorial Assistant has put this roundup together.