Loss of Profit and Profitability: Distinct Concepts, Frequently Confused

by Ramkishore Karanam* and Preethi Sivaraman**

by Ramkishore Karanam* and Preethi Sivaraman**

Central Sales Tax Act, 1956 — S. 8(5) (after 2002 Amendment) and S. 8(4) — Applicability of S. 8(5) after amendment to

by Devadipta Das* and Shradha Pandey**

Arbitration and Conciliation Act, 1996 — Ss. 11 & 8 and 16 r/w S. 7: Law clarified on harmonious construction of Arbitration

by Yash Bajpai* and George Janssen**

by Rajat Pradhan* and Deepshikha Bhati**

“Educational certificates are not marketable commodities within the meaning of Section 171 of the Contract Act, 1872.”

by Nishant Verma†

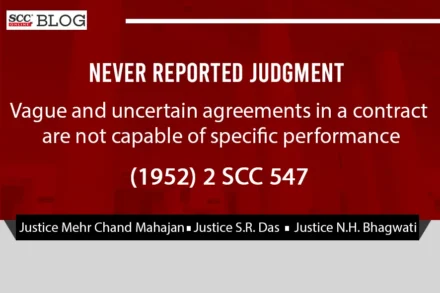

This report covers the Supreme Court’s Never Reported Judgment dating back to the year 1952 on specific performance of contract.

by Vasanth Rajasekaran* and Harshvardhan Korada**

Cite as: 2024 SCC OnLine Blog Exp 13

Liquidated Damages: In this article, the author clarifies misconceptions which have arisen about Section 74 of the Contract Act because of certain

The Court is not meant to act as a Court of first appeal and cannot supplant its view over that of the Arbitral Tribunal.

The principle governing the evidence in civil cases is that there should be a preponderance of the events which should be proved unlike in criminal matters, where the evidence have to be proved beyond a reasonable doubt. Moreover, the burden of proof is on the party which will suffer if such evidence is not proved.

The agreement between the parties is not a contract between an employee-employer or a manager-sportsperson contract, rather they are commercial contracts entered into between parties with equal bargaining power and for mutual commercial benefit. Thus, the agreements between the parties are neither ‘excessively one sided’ nor they impose a ‘bondage’.

by Vasanth Rajasekaran*

Cite as: 2023 SCC OnLine Blog Exp 67