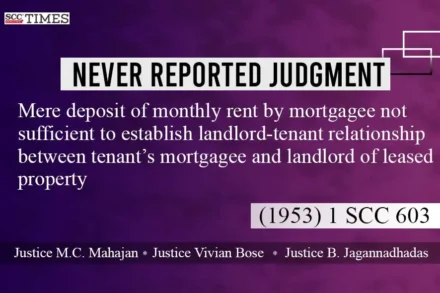

Never Reported Judgment | Mere deposit of monthly rent by mortgagee not sufficient to establish landlord-tenant relationship between tenant’s mortgagee and landlord of leased property [(1953) 1 SCC 603]

This report covers the Supreme Court’s Never Reported Judgment dating back to the year 1953 on landlord-tenant relationship.