CAM Secures Landmark CESTAT Ruling for Smith & Nephew on Concessional Customs Duty for Medical Implants

The ruling is first of a kind decision, setting a precedent for more such companies dealing with implants in India.

The ruling is first of a kind decision, setting a precedent for more such companies dealing with implants in India.

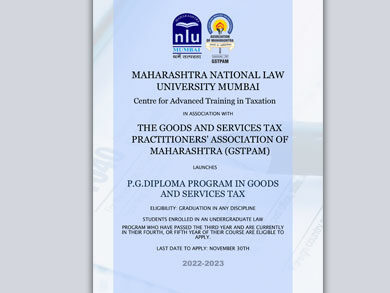

Journal on Corporate Law & Commercial Regulations under the aegis Centre for Research and Training in Corporate Regulations of Maharashtra National Law

About MNLU Maharashtra National Law University Mumbai, established under the Maharashtra National Law University Act 2014 on 20th March 2014, is one

by Tarun Jain†

Cite as: 2022 SCC OnLine Blog Exp 85

The bench of MR Shah and M.M Sundresh, JJ explained the importance of the words “or otherwise” inserted to Section 45(4) of the Income Tax Act, 1961 by the Finance Act, 1987

by Tarun Jain†

Cite as: 2022 SCC OnLine Blog Exp 68

“A judicial remedy must be effective, independent and at the same time certain. Certainty of forum would involve unequivocal vesting of jurisdiction to adjudicate and determine the dispute in a named forum.”

Supreme Court: In an important ruling of Goods and Service Tax (GST), the bench of KM Joseph* and Hrishikesh Roy, JJ has

Karnataka High Court and ITAT committed a “grave error” in holding that the requirement of furnishing a declaration under Section 10B (8) of the Income Tax Act, 1961 (IT Act) is mandatory, but the time limit within which the declaration is to be filed is not mandatory but is directory.

Appellate Authority for Advance Ruling, Punjab: Arun Narayan Gupta Chief Commissioner, CGST Commissionerate, and Kamal Kishor Yadav, Commissioner of State

Supreme Court settled the issue of whether “body corporate” is excluded from the definition of “consulting engineer” under Section 65(31) of the Finance Act, 1994 prior to the amendment in 2005.

Maharashtra Authority for Advance Ruling: Rajiv Mangoo, Additional Commissioner of Central Tax & T.R. Ramani, Joint Commissioner of State Tax held that

Supreme Court: In the case where the constitutionality of two Central Government notifications related to levy of Integrated Goods and Services Tax

It is essential to look beyond the mere concept of destruction of corporate entity which brings to an end or terminates any assessment proceedings.

Supreme Court: In the instant appeals, the Market Committees located in Rajasthan raised their grievance over the decision of CESTAT that respective

Supreme Court: Explaining the scope of jurisdiction of ITAT, the bench of MR Shah* and BV Nagarathna, JJ has held that the

“The common portal is only a facilitator to feed or retrieve such information and need not be the primary source for doing self-assessment.”