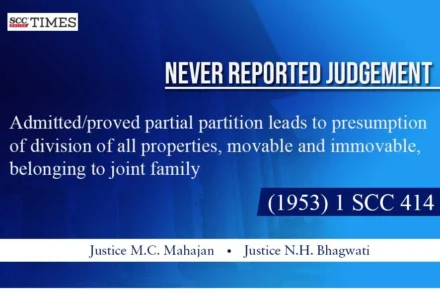

Never Reported Judgment | Admitted/proven partial partition leads to presumption of division of all properties, movable and immovable, belonging to joint family [(1953) 1 SCC 414]

This report covers the Supreme Court’s Never Reported Judgment dating back to the year 1953 on partial partition.