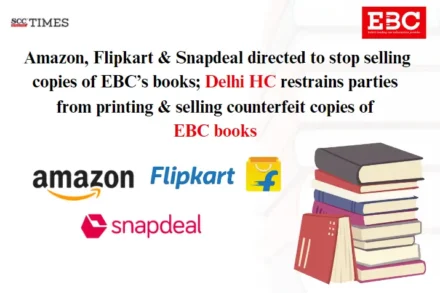

Amazon, Flipkart & Snapdeal directed to stop selling counterfeit copies of EBC’s books; Delhi HC restrains parties from printing & selling counterfeit copies of EBC books

The Court directed the Commissioners to conduct a search at the book houses and seize the infringing products bearing EBC’s registered trade marks or containing contents identical or deceptively similar to EBC’s books, books without hologram, packaging, labels, printing material and other material that reflect infringement of copyright and trade mark.