Monsoon Session of Parliament 2025: A Comprehensive Overview

Read the overview of Parliament’s Monsoon Session 2025, highlighting major bills, key reforms, and the government’s push for inclusive and digital governance.

Read the overview of Parliament’s Monsoon Session 2025, highlighting major bills, key reforms, and the government’s push for inclusive and digital governance.

The international conference aims to foster interdisciplinary conversations that reflect the rapidly evolving legal landscape of global finance and governance, the last date of abstract submission is 21st August, 2025

The Union Internationale des Avocats (‘UIA’) has organized a two- day seminar on the theme ‘India Ahead: Exploring legal, regulatory and geopolitical updates impacting FDI in the world’s fastest growing economy’. The seminar will be held at the Delhi International Arbitration Centre (‘DIAC’), Delhi High Court, on 29th and 30th March, 2025.

Industry experts seem cautiously optimistic, acknowledging the budget’s potential to foster long-term economic resilience while urging attention to execution.

The Supreme Court’s 2024 decisions have marked a significant turning point in the country’s legal and constitutional framework. Key rulings delivered by Constitutional Benches on Electoral bonds, private property, royalty as tax, AMU’s minority status, sub-classification within reserved categories, etc. have left an impact on fundamental rights, political transparency and tax regime, shaping India’s socio-political landscape, influencing both public policy and the broader democratic process.

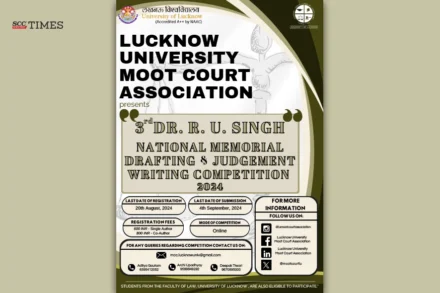

ABOUT THE COMPETITION Don’t forget no-one else sees the world, the way you do, so no-one has got things you can tell.

The firm promoted 12 Associate Partners to Partners. This elevation aims at enhancing the firm’s capability to deliver robust and valued solutions across its practice areas

“The conclusion that the taxable person is providing a service to the supplier while taking the benefit of a discount by facilitating an increase in the volume of sales of such supplier, is ex facie erroneous and contrary to the fundamental tenets of GST law. Therefore, this conclusion warrants interference, and this issue requires re consideration.”

BAFT Service Provider will undertake Bookkeeping, Accounting, Taxation & Financial Crime Compliance Services.

“Taxation serves as the cornerstone of governmental revenue, facilitating the provision of public services and infrastructure. Essential to this system is consistency, ensuring that similar factual and legal circumstances are met with uniform treatment.”

About RGNUL The Rajiv Gandhi National University of Law (RGNUL), Punjab, was established by the State Legislature of Punjab by passing the

“The members of the club are seen both as contributors and participators. The club and its members are seen as one person. Usually a member has to pay to avail of the services and facilities provided by the club.”

In a 106 pages long verdict, the Supreme Court has decided whether a credit note issued by a manufacturer to a dealer of automobiles in consideration of the replacement of a defective part, using spare parts from dealer’s own stock or from an open market, in the automobile sold pursuant to a warranty agreement being collateral to the sale of the automobile, will be exigible to sales tax.

by Tarun Jain†

Cite as: 2023 SCC OnLine Blog Exp 45

The Revenue had submitted that the Assessing Officer is competent to consider all the material that is available on record, including that found during the search, and make an assessment of ‘total income’. While some of the High Courts agreed with the said proposition, some disagreed. The Supreme Court was, hence, called upon to resolve the conundrum.

About Rajiv Gandhi National University of Law, Punjab Rajiv Gandhi National University of Law (RGNUL), Punjab, was established by the State Legislature

The amendment in Section 153-C of the Income Tax, 1961 was brought and the words “belongs or belong to” were substituted by the words “pertains or pertain to” after a ruling by Delhi High Court in Pepsico India Holdings Private Limited v. ACIT, 2014 SCC OnLine Del 4155.