IBC

IBC vests decisive authority on CoC’s commercial wisdom; Confines judicial review strictly under Ss. 30(2) & 61(3) IBC: Supreme Court

“Commercial wisdom of the CoC enjoys primacy and cannot be supplanted by judicial review. Neither the NCLT, nor the NCLAT nor even this Court is empowered to substitute its assessment in place of the commercial decision arrived at by a requisite majority of the CoC”.

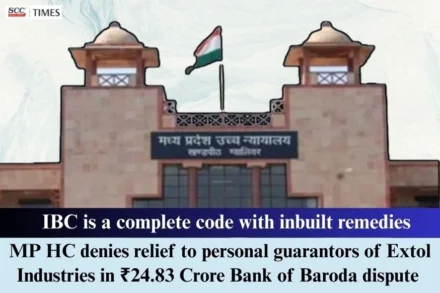

IBC is a complete code with inbuilt remedies; MP HC denies relief to personal guarantors of Extol Industries in ₹24.83 Crore Bank of Baroda dispute

The Court noted that despite filing an appeal before the NCLAT, the petitioners filed the present writ petition challenging the demand notice issued by the Bank.

From Distressed Financing to Cross-Border Insolvency: Insights from 3rd IBBI & INSOL India International Conclave 2026

The 3rd IBBI—INSOL India International Conclave 2026 brought together leading domestic and international experts to deliberate on out-of-court restructurings, distressed acquisitions, and cross-border insolvency frameworks within the context of India’s evolving insolvency ecosystem.

Climate, Economic Tribunals and Turnarounds take centre stage on Day 3 of the 4th ILA Conference

On Day 3 of the 4th Insolvency Law Academy Annual Conference, discussions centred on climate change and insolvency, institutional challenges facing economic law tribunals, the evolving turnaround framework, and contemporary insolvency scholarship.

From Group Insolvency to Modified Universalism: Experts provide insights on Day 2 of the 4th ILA Conference

Taking Day 2 of the 4th Insolvency Law Academy (“ILA”) Annual Conference further, the panellists and guests delved into topics such as cross-border insolvency, future of restructuring, group insolvency, hybrid insolvency, and much more.

Experts deliberate on entrepreneurship, risk and second chances at Day 2 of the 4th ILA Conference

Day 2 of the much-awaited 4th ILA Conference brought together eminent voices from India and abroad to examine insolvency law through the lens of entrepreneurship, risk-taking, and the importance of dignified second chances.

“Way forward is not radical reinvention but institutional course correction”: Justice N.V. Ramana speaks at Day 1 of the 4th ILA Conference

Day 1 of the much-awaited 4th ILA Conference featured erudite addresses and insights from leading insolvency experts and distinguished dignitaries on insolvency law and policy, global trends in restructuring, the changing geopolitical landscape, and cinema as a lens and mirror for the economy.

2025 SCC Vol. 10 Part 4

2025 SCC Vol. 10 Part 4: Explore the latest Supreme Court Cases on Arbitration, IBC, Service Law, and Transfer of Property.

2025 SCC Vol. 9 Part 5

2025 SCC Vol. 9 Part 5: Explore the latest Supreme Court Cases on Arbitration, Civil Procedure Code, Consumer Commissions, Election Law, NI Act, Service Law, and IBC.

2025 SCC Vol. 9 Part 4

2025 SCC Vol. 9 Part 4: Explore the latest Supreme Court Cases on Civil Procedure Code, Constitution, Criminal Law, Motor Vehicles Act, and IBC.

2025 SCC Vol. 9 Part 3

2025 SCC Vol. 9 Part 3: Explore the latest Supreme Court Cases on Forest Act, Motor Vehicles Act, NI Act, Commercial Courts Act, and IBC.

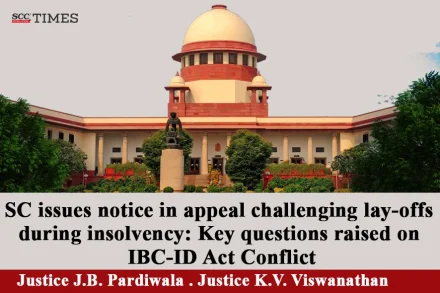

SC issues notice in appeal challenging lay-offs during insolvency: Key questions raised on IBC-ID Act Conflict

The appeal challenges the NCLAT’s order upholding a purported lay-off by Resolution Professional, which the appellant claims was a disguised and unlawful retrenchment. The Court is set to examine whether IBC overrides ID Act provisions and whether such retrenchments can legally occur under the garb of lay-offs during insolvency proceedings.

2025 SCC Vol. 8 Part 3

2025 SCC Vol. 8 Part 3: Explore the latest Supreme Court Cases on Income Tax, IBC, Criminal Law, NDPS, and Customs.

SAM & Co. advises Committee of Creditors of Hindusthan National Glass & Industries Ltd. on INR 2500 Crore Resolution

The transaction achieved a recovery of approximately INR 2500 Crores for creditors, including 74.89% for secured financial creditors.

Breakdown of Supreme Court verdict in Bhushan Power & Steel Insolvency case

“The Corporate Debtor in the present case was running into substantial losses which has now become a profit-making entity earning substantial profits. The SRA — JSW invested huge amounts in modernization and expansion of the entity. Not only that but thousands of employees have been earning their livelihood on account of the Corporate Debtor running as an on-going concern due to the Resolution Plan being implemented by the SRA — JSW.”