2025 SCC Vol. 5 Part 4

2025 SCC Vol. 5 Part 4: Explore the latest Supreme Court Cases on the Cooperative Societies, Motor Vehicles Act, Service Tax, CrPC, Contract, Constitution, Human and Civil Rights, and Public Premises Act.

2025 SCC Vol. 5 Part 4: Explore the latest Supreme Court Cases on the Cooperative Societies, Motor Vehicles Act, Service Tax, CrPC, Contract, Constitution, Human and Civil Rights, and Public Premises Act.

2025 SCC Vol. 5 Part 3: Explore the latest Supreme Court Cases on the Arbitration, IBC, CPC, Contract, Criminal Law, Education Law, Labour Law and Land Acquisition.

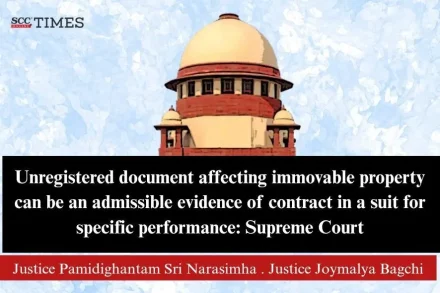

In S. Kaladevi v. V.R. Somasundaram, (2010) 5 SCC 401, the Supreme Court had held that an unregistered document may be received as evidence of a contract in a suit seeking specific performance.

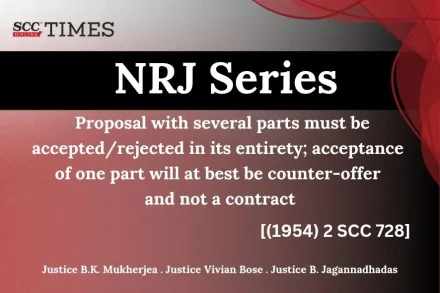

This report covers the Supreme Court’s Never Reported Judgment on what constitutes as a contract, dating back to the year 1954.

The Court said that governmental entities must be treated in a similar fashion to private parties insofar as proceedings under the Arbitration Act are concerned, except where otherwise indicated by law.

“There is no dispute as to the power of the courts to award interest on interest or compound interest in a given case subject to the power conferred under the statutes or under the terms and conditions of the contract; but where no such power is conferred ordinarily, the courts do not award interest on interest”.

The Delhi High Court said that the scope of interference with arbitral awards under Section 34 of the Arbitration and Conciliation Act, 1996 has now become heavily circumscribed.

Relying on UN Krishnamurthy v. AM Krishnamurthy, the Court stated that the appellant failed to indicate willingness to perform their part of the transaction, as they neither showed nor proved the availability of sufficient funds required to make the payments per the contract

‘A reference to the document in the contract should be such that shows the intention to incorporate the arbitration clause contained in the document into the contract’

Supreme Court concluded that the instant matter was not one of ‘incorporation’ but a case of ‘reference’ and clarified that a general reference would not have the effect of incorporating arbitration clause.

In 2001, the appellant, Director of Education under the aegis of the Directorate of Education created by the Government of NCT of Delhi, floated a tender for the implementation of the Computer Education Project (“CEP-II”) for various government/ government aided Senior Secondary Schools, and Educomp Solutions a provider of technology-based educational products and services was awarded the contract.

A party cannot simply raise an objection on the ground of patent illegality if the Award is against them. Patent illegality requires a distinct transgression of law, the clear lack of which makes the petition a pointless effort of objection towards an Award passed by a competent Arbitral Tribunal.

The question before the Court was whether an application remaining pending for an unreasonable period could in itself be classified as an arbitrary and unreasonable act?

Court was also of the view that signature in a classic presentation and does denote identity and confirmation of an agreement; however, that in itself does not prevent the use of a modern- day emoji such as thumbs-up emoji.

Where parties decide to put an end to the original contract as if it never existed and substituted a new contract with it, then in such a situation the original contract is extinguished by the substituted one and the arbitration clause of the original one perishes with it.

Sections 20-A and 41(ha) of the Specific Relief Act, 1963 expresses the legislative intent to not grant injunctions relating to infrastructure projects where delay may be caused by such an injunction. Thus, the role of Courts in this exercise is to interfere to the minimum extent so that public work projects are not impeded or stalled.

Section 52 of the Transfer of Property Act is an expression of the principle “pending a litigation nothing new should be introduced”. It provides that pendente lite, neither party to the litigation, in which any right to immovable property is in question, can alienate or otherwise deal with such property so as to affect his appointment

The writ court should not exercise its powers under Article 226 of the Constitution which will obstruct contractual rights between the parties.

Allahabad High Court rejected the contention of the petitioner that since forms are filled up by the agents/officers of LIC, anything omitted would not constitute ground for repudiation/rejection of the claim.

The Collaboration Agreement is a commercial transaction between the private parties and hence the same by its very nature is determinable, even if there is termination clause in the Collaboration Agreement