Khaitan & Co Announces 30 New Partner Promotions

Khaitan & Co, a leading full-service law firm, has announced the promotion of 30 Partners and 20 Counsel

Khaitan & Co, a leading full-service law firm, has announced the promotion of 30 Partners and 20 Counsel

After applying the definition of Railway as defined under the Railways Act, 1989, to the contract between the petitioner and RVNL, it would constitute that the work specified under the contract is the original work pertaining to railway for the purpose of the subject notification and thus, covered under Serial No. 3(v)(a) of the notification dated 28-06-2017 issued by Central Government.

The Central Board for Direct Taxes was also directed to take necessary steps for rectifying the software as the issue may not be resolved by the Jurisdictional Assessing Officer.

“In the event of wrong availment of input tax credit, the proceedings can be initiated against the registered person or registered dealer but at the same time, restrictions has been imposed upon the authorities that without putting notice to the dealer, no adjudication proceeding can be initiated.”

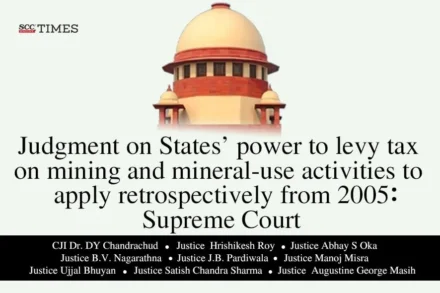

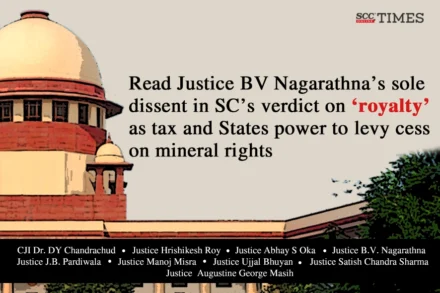

On 25-07-2024, the Supreme Court in 8:1 majority held that royalty paid by mining operators to the Central government is not a tax and that States have the power to levy cesses on mining and mineral-use activities. Whereas, Justice BV Nagarathna gave a dissenting opinion.

“Royalty is in the nature of a tax or an exaction. It is not merely a contractual payment but a statutory levy under Section 9 of the MMDR Act.”

by Shivam Mehta†, Tanya Garg †† and Srijita Chakraborty†††

Supreme Court said that authorizing the Central Government to lay down the terms of mining leases and grant approval to concessions, the MMDR Act seeks to ensure that there is uniformity in the terms for working of mines and extraction of minerals.

“The payments made to the Government cannot be deemed to be a tax merely because the statute provides for their recovery as arrears”.

This matter was the oldest pending nine-judge Bench case before the Supreme court. The Bench had reserved its judgment in the matter on 14-03-2024

Supreme Court said the petitioners must consider challenging the State provision in the Act and that they should have first approached their jurisdictional High Courts to challenge their respective State enactments.

Shardul Amarchand Mangaldas & Co and National Law School of India University, Bengaluru, are inviting applications from law colleges across India to

“The conclusion that the taxable person is providing a service to the supplier while taking the benefit of a discount by facilitating an increase in the volume of sales of such supplier, is ex facie erroneous and contrary to the fundamental tenets of GST law. Therefore, this conclusion warrants interference, and this issue requires re consideration.”

Justice (Retd.) Sanjaya Kumar Mishra’s appointment marks the beginning of the operationalisation of the GSTAT, a crucial body for resolving GST-related disputes.

by Yogendra Aldak†, Pranav Mundra†† and Balraaj Singh Chhatwal†††

by Nirav S. Karia† and Vatsal Bhansali††