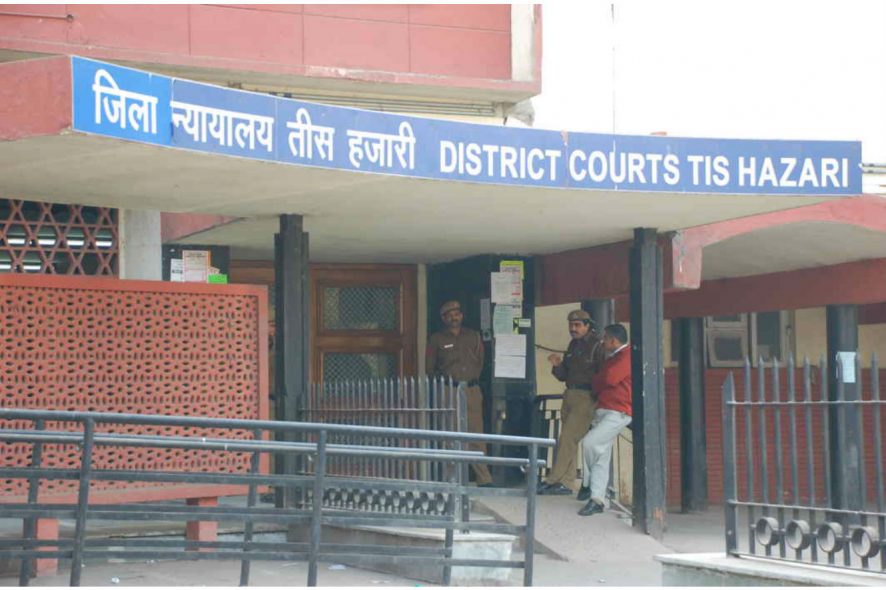

Abhinav Pandey, MM, Tis Hazari Court directs Delhi Police to lodge FIR and investigate allegations of fraud in crypto transactions.

Complainant sought directions to the police for registration of FIR and commencement of investigation, into the offences alleged by the complainant to have been committed by the accused.

It was submitted by the complainant that he deals in the sale and purchase of bitcoins, and while doing that he always takes proof of identity before entering into any trade transactions and that he also pays taxes on the gains that he makes in such trade.

Further, it was added that the accused had purchase bitcoins on several occasions, and he used to transfer funds to the bank account of the complainant, in return for which, complainant used to transfer bitcoin to the accused’s virtual wallet on the online transaction portal “Binance”.

Complainant submitted that his bank accounts were frozen on the ground of his transaction in bitcoins to be marked as illegal transactions.

On confronting accused on the legality of the money paid by the accused against bitcoins, the accused admitted that the payments were a ‘scam’ and further he refused to return the bitcoins transferred by the complainant.

Complainant states that he was cheated by the accused and Court intervention was sought in view of the same.

Analysis, Law and Decision

Bench on perusal of the facts and submissions of the matter opined that its jurisdiction was made out in view of the provisions of Section 179, 180 and 182 of CrPC, and due to the absence of any material filed by the police to suggest to the contrary.

CRUX

Whether the complainant himself was carrying out a lawful activity, and whether he himself has come to this Court with clean hands?

Bench noted that RBI in its’ circular dated 6-04-2018 had cautioned the users, holders and traders of virtual currencies while directing the banks and financial institutions regulated by it, not to deal in virtual currencies and not to provide services eg. maintaining accounts, registering, trading, settling, clearing, giving loans and accepting VCs as collaterals, opening accounts of exchanges dealing with them etc., for facilitating any person or entity in dealing with virtual currencies.

Though, the above-stated circular was set aside by the Supreme court in its decision of Internet & Mobile Assn. of India v. Reserve Bank of India, (2020) 10 SCC 274.

But another fact observed by the Court was that the above decision of the Supreme Court did not adjudicate upon the legality of the virtual currency and there was no specific legislation too, as on date, specifically dealing with the legality and regulation of cryptocurrency.

Further, the Bench remarked that the cryptocurrency transaction will comply with the general law in force including PMLA, IPC, FERA, NDPS Act, Tax laws, and with the RBI regulations regarding KYC (know your customer), CFT (Combating of funding of terrorism) and AML (Anti-money laundering requirements).

KYC is the responsibility of the intermediary and cannot be left to the individuals be it institutional transfer or person to person trade, with the intermediary shying away from the responsibility to ensure legitimacy of the source of money and establishment of real identity of the parties.

BINANCE

Responsibility of ‘BINANCE’ is to ensure adequate safeguards against activities such as ‘mixing’ and other random cryptocurrency exchanges, which change the identity of bitcoins being held by a virtual wallet, making tracing of any illegal proceeds and any bitcoins, purchased through it, extremely difficult.

Legal and Regulatory Escape: Is there an existence?

Proceeding to make some more significant observations, Court stated that the opportunistic activities, aimed at exploiting the lack of legal regulation, with utter disregard to the identity of parties, sources and destination of funds, and illegal purposes e.g. terrorism, narcotics, illegal arms, cross-border illegal transactions for which it may be used, still do not enjoy any route for legal and regulatory escape.

Therefore, the aforementioned aspects have to be investigated in detail, and any negligence or complicity of the online VC transaction portal “BINANCE” in perpetration of hiding the proceeds of crime, and in the funding of any illegal activities through cryptocurrency has to be inquired into.

Culpability of accused

Prima facie the screenshots of the conversation with the accused imply the knowledge of the accused regarding the source of money.

Bench noted that the accused was already an accused in two other cybercrime FIRs, hence,

it is quite possible that apart from being involved in the aforesaid cyber offences, the accused may have hid the factum of illegality of money from the complainant, thereby inducing him to deliver bitcoins in exchange of money, while being aware of the fact that it may, sooner or later come under the radar of the banking system, and so it is better to get rid of the same, purchase bitcoins and multiply/ mix transactions to hide its source, and to encash it from ‘safe haven’ countries, where there is absence or lack of regulations.

As per the Court, there was a possibility that the complainant was unaware of the designs of the accused and fell into his trap.

But complainant’s possibility of giving his consent in the entire gamut of activities could not be ruled out since he did not reveal the complete facts to the Court as he went on accepting the amount from different accounts which may not have been a mere lack of caution or due diligence.

In one of the WhatsApp conversations annexed alongwith the complainant, the accused is seen advising the complainant to clear his bank accounts immediately on receipt of any consideration against sale of bitcoins, and the complainant fails to be alarmed, thanks the accused for such advice, and admits that he immediately converts any such consideration back to cryptocurrency.

Yet, the complainant on being fully aware of the legal consequences has approached the Court.

While concluding the matter, Bench held that cognizable offence under Sections 403, 411 and 420 of Penal Code, 1860 were prima facie committed and the real culprits need to be identified.

Bench made another crucial observation that the possibility of the complainant, accused and the online intermediary, being hand in glove cannot be denied too, whereby the accused may have been involved in hacking/cyber-crimes against unsuspecting persons, and transferring the same immediately to the complainant against bitcoins, thus creating a chain of transactions difficult to follow up till the amount is invested in any illegal activity, or is withdrawn in a ‘safe haven’ jurisdiction. The exchange intermediary may either be involved, or may just be keeping its eyes shut to all such activities carried out through it.

Lastly, the Court stated that it is possible that any of the said persons/intermediaries may come out to be innocent or just negligent, hence there is a need for police investigation to be extremely technical.

Registration of FIR does not mean that the accused is to be automatically arrested, and the concerned provisions of CrPC shall apply.

Status of investigation to be informed on 6-08-2021. [Hitesh Bhatia v. Kumar Vivekanand, Case No. 3207 of 2020, decided on 1-07-2021]

Counsel for the Complainant: Mr. Bharat Chugh and Advocate Sai Krishna.

nice article

Blockchain got hyped due to lot of buzz around cryptocurrency . We need to understand first what is blockchain and why is it gaining so much popularity. Love to read more!!